New penalties for late filing of annual returns from 14 January 2022

Last updated on 15 January 2022

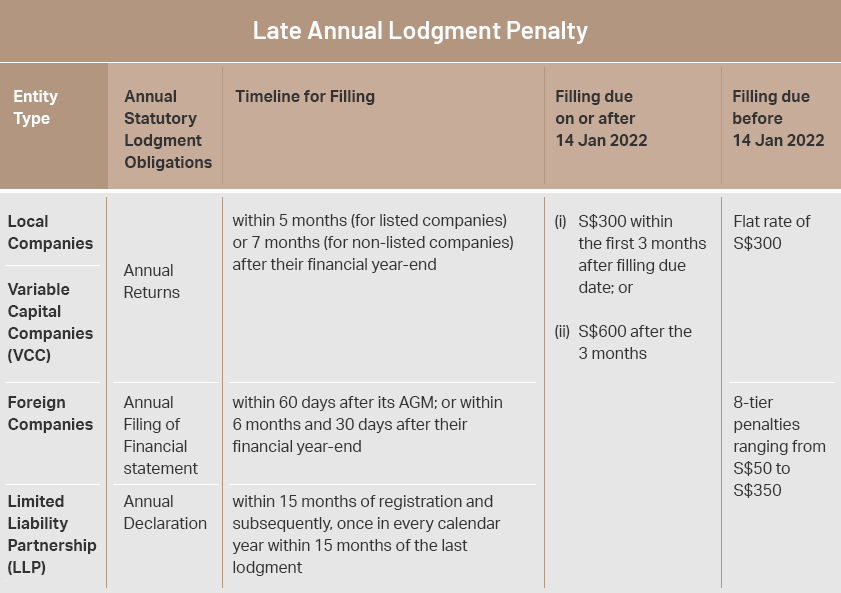

With effect from 14 January 2022, penalties for late filing of annual statutory lodgments by Local Companies, Variable Capital Companies (VCCs), and Limited Liability Partnerships (LLPs) will go up to S$600 if filed more than 3 months after the due date. If late filing falls within 3 months of the due date, the penalty will be S$300.

The new rules apply to all annual lodgments due on or after 14 January 2022. For annual lodgment due before then, the previous penalty framework of S$300 for late filing continues to apply. For fuller details, see the table below.

It is mandatory for every company to file its Annual Return (AR), including dormant companies. Before filing AR, companies may need to send their financial statements (FS) to members before their Annual General Meeting (AGM). Some companies may need to file their AR with their FS in XBRL format.

Companies that require more time can apply to ACRA for an extension of time of 60 days to file the annual return and up to 2 months for a foreign company. The application must be submitted before the deadline of annual filing (you are advised to submit more than 14 working days before the deadline) and a fee of S$200 is applicable.

Company directors are responsible for ensuring that their companies meet obligations to file their AR on time. Failure to do so may result in court prosecution of the company and its directors. In addition, directors who are convicted of three or more filing-related offenses under the Companies Act within a period of five years will be disqualified as a director. ACRA may also initiate striking off of companies for not filing its AR.

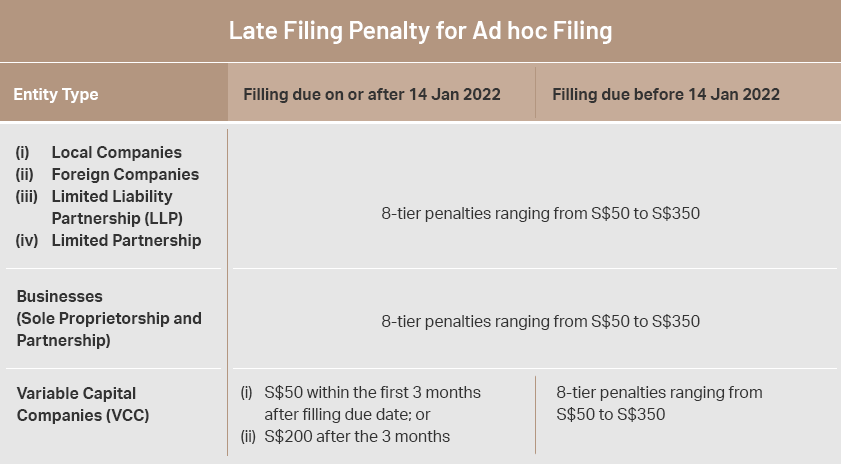

For all ad hoc filings by companies, such as a change in entity information, the existing penalty framework will continue to apply for late filing of such lodgments., For ad hoc filings by VCCs, a 2-tier penalty framework will apply for all late filings, with effect from 14 January 2022.

To ensure compliance with the preparation of financial statements and filing obligations under the Companies Act, directors may engage companies providing corporate secretarial and accounting services in Singapore.