Budget 2024 gives businesses help and boosts Singapore’s attractiveness

Last updated on 4 March 2024

Singapore’s Deputy Prime Minister and Finance Minister Lawrence Wong recently announced a slew of measures in his Budget 2024 Speech that directly and indirectly impact businesses. We share some of the critical measures here.

Corporate Income Tax (CIT) rebate and cash grant

The Government will give all companies a CIT tax rebate of 50% of tax payable for YA2024. The rebate is on top of a CIT cash grant of up to $2,000 to be paid in cash to companies. To qualify for the cash grant, companies need to have employed at least one Singapore citizen or permanent resident in the calendar year 2023. The employees cannot be shareholders who are also directors of the company.

The 50% CIT rebate will be automatically deducted during the CIT assessment phase. The cash rebate will be deducted from the total rebate the company qualifies for. The maximum rebate and cash grant is $40,000.

Renovation or refurbishment (R&R) expenditure

The tax-deductible for R&R expenditure will be enhanced from YA2025. The enhancements include expanding the scope of qualifying expenditure and fixing the relevant 3-year assessment period for all businesses. More details will be announced in later in 2024.

Base Erosion and Profit Shifting (BEPS) 2.0 initiative

A Domestic Top-up Tax (DTT) and Income Inclusion Rule (IIR) will be implemented from the financial years starting on or after 1 January 2025 under Pillar Two of BEPS 2.0. The 2 measures will impose a minimum effective tax rate of 15% on business profits of multinational enterprise (MNE) groups with annual group revenue of €750 million or more in at least two of the four preceding financial years.

The IIR will apply to MNE groups parented in Singapore for the profits of their group entities operating outside Singapore. The DTT will apply to MNE groups for the earnings of their group entities that are operating in Singapore.

Tax incentive schemes for funds

To further support the growth of Singapore’s asset and wealth management industry funds domiciled in Singapore (“Qualifying Funds”) are eligible for tax incentive programmes. The tax incentive schemes under Sections 13D, 13O, and 13U of the Income Tax Act 1947 will be extended until 31 December 2029.

Limited Partnerships registered in Singapore can now participate in the Section 13O programme. Sections 13D, 13O, and 13U schemes’ qualifying funds’ economic requirements will also be updated. IRAS will release details at a later date.

Fund accounting firms in Singapore are an excellent resource to tap for fund administration services when the above changes take place.

Refundable Investment Credit (RIC) scheme

The RIC will be introduced to enhance Singapore’s attractiveness for investments by providing support of up to 50% on qualifying expenditure for a qualifying project. The scheme will be administered by the Economic Development Board and Enterprise Singapore, and each award will have a qualifying period of up to 10 years.

Activities that qualify under RIC include:

- Investing in new productive capacity (e.g., new manufacturing plant, production of low-carbon energy);

- Expanding or establishing the scope of activities in digital services, professional services, and supply chain management;

- Expanding or establishing headquarter activities, or Centres of Excellence;

- Setting up or expansion of activities by commodity trading firms;

- Carrying out R&D and innovation activities; and

- Implementing solutions with decarbonisation objectives.

Qualifying expenditure categories may include capital expenditure, manpower costs, training costs, professional fees, intangible asset costs, fees for work outsourced in Singapore, materials, consumables, freight and logistics costs.

To confirm which activities and expenditure categories qualify for the RIC scheme, seek the advice of accounting firms in Singapore.

CPF contribution rate for senior workers

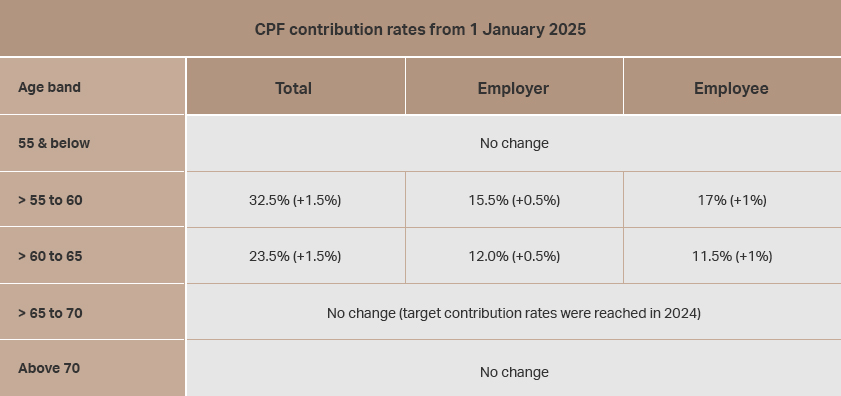

The next increase in senior workers’ CPF contribution rates for workers aged above 55 to 65 will take place on 1 January 2025 as follows:

Additionally, the Government announced a one-year CPF Transition Offset equal to half of the 2025 increase in employer CPF contributions for every Singaporean and Singapore Permanent Resident employee over the age of 55 to 65. The offset aims to lessen the rise in business costs brought on by this increase.

To ensure your company’s CPF contribution amounts comply with the latest revised rates, engage a company offering HR & payroll and bookkeeping services in Singapore.