IRAS updates guidelines on foreign income and tax residency in Singapore

Last updated on 15 May 2024

The Inland Revenue Authority of Singapore (IRAS) recently updated its guidelines on corporate tax filing requirements for foreign income and the assessment and considerations of corporate tax residency in Singapore.

Generally, all income accrued in or derived in Singapore is taxable. Income from outside of Singapore but received in Singapore is also subjected to corporate tax treatment (i.e. foreign income received by Singapore residents or Singapore-located business entities).

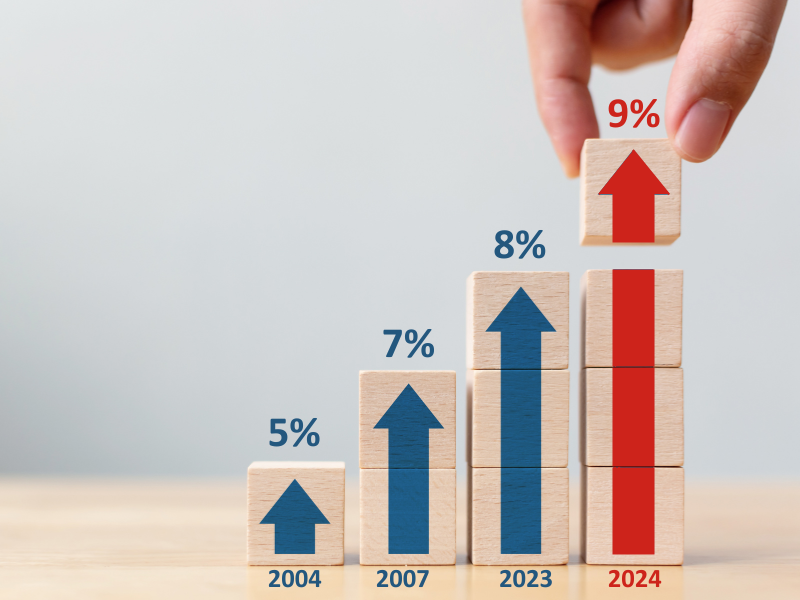

From the Year of Assessment (YA) 2024, the following changes apply to foreign income and are required to be included in corporate tax computations:

- Unremitted foreign income brought forward from prior YAs

- Foreign income earned in the current financial year

- Foreign income received in Singapore during the financial year

- Foreign income used during the year and not received in Singapore

- Unremitted foreign income carried forward

- Tracking of allowable expenses attributable to the foreign income if the company is electing for the liberalised treatment of expenses incurred in Singapore

The new reporting requirements ensure companies track the foreign income they receive in Singapore. IRAS has created a standard template that businesses can use to help them comply with the reporting requirement. Companies can engage accounting firms in Singapore that provide tax services to assist in tax computation and comply with reporting requirements.

As Singapore is a business and financial hub, many foreign business owners are setting up company in Singapore. A significant consideration for foreign-owned entities is the issue of tax residency in Singapore. Under Singapore tax law, the tax residency of a company is determined by where the business is controlled and managed and may change from year to year. A company is a tax resident in Singapore if the control and management of the business is exercised in Singapore and often holding the Board of Directors’ meeting in Singapore satisfies the requirement.

For a given YA, a company is generally regarded as a tax resident of Singapore if its management and control were exercised in Singapore throughout the previous calendar year.

IRAS has introduced new guidelines to determine Singapore tax residency to address the issues of using virtual meeting technologies for board meetings, where directors need not be physically present. Under the new guidelines, a company’s management is considered to have been exercised in Singapore if the following conditions are met:

- At least 50% of the directors (with the authority to make strategic decisions) are physically in Singapore during the meetings; or

- The Chairman of the Board of Directors (if the company has such an appointment) is physically in Singapore during the meeting.

Companies can apply for a certificate of residency to prove their tax residency. This certificate can be used to claim tax benefits in countries where Singapore has Double Taxation Agreements. Corporate services providers offering accounting services in Singapore can assist foreign companies with this process.