X

Incorporation

Corporate Secretarial

Immigration

HR and Payroll

Business Advisory

Operational & Process Excellence

Digital Capabilities and Performance Improvement

Other Business Support

Setting up family office in Singapore is similar to setting up company in Singapore, with a few more steps and considerations involved.

Singapore has a reputation as a jurisdiction with a stable government and robust legal structures that is conducive for business. It has a measured approach to regulation with agencies such as the Economic Development Board (EDB) and Monetary Authority of Singapore (MAS) promoting a business-friendly environment.

Wealthy families worldwide are always looking for ways to manage their wealth in a more efficient and professional manner, often by establishing family offices.

Factors that make Singapore an attractive location to set up a Single Family Office include:

In Singapore, a Single Family Office (SFO) manages the wealth of members of a single family and is typically incorporated as a private limited company limited by shares. These shares may be held by the holding company of the family office, by common shareholders with the family fund entity, or by a family trust.

Setting up an SFO instead of having ad-hoc solutions to resolve wealth management problems for the family has many benefits. These benefits include:

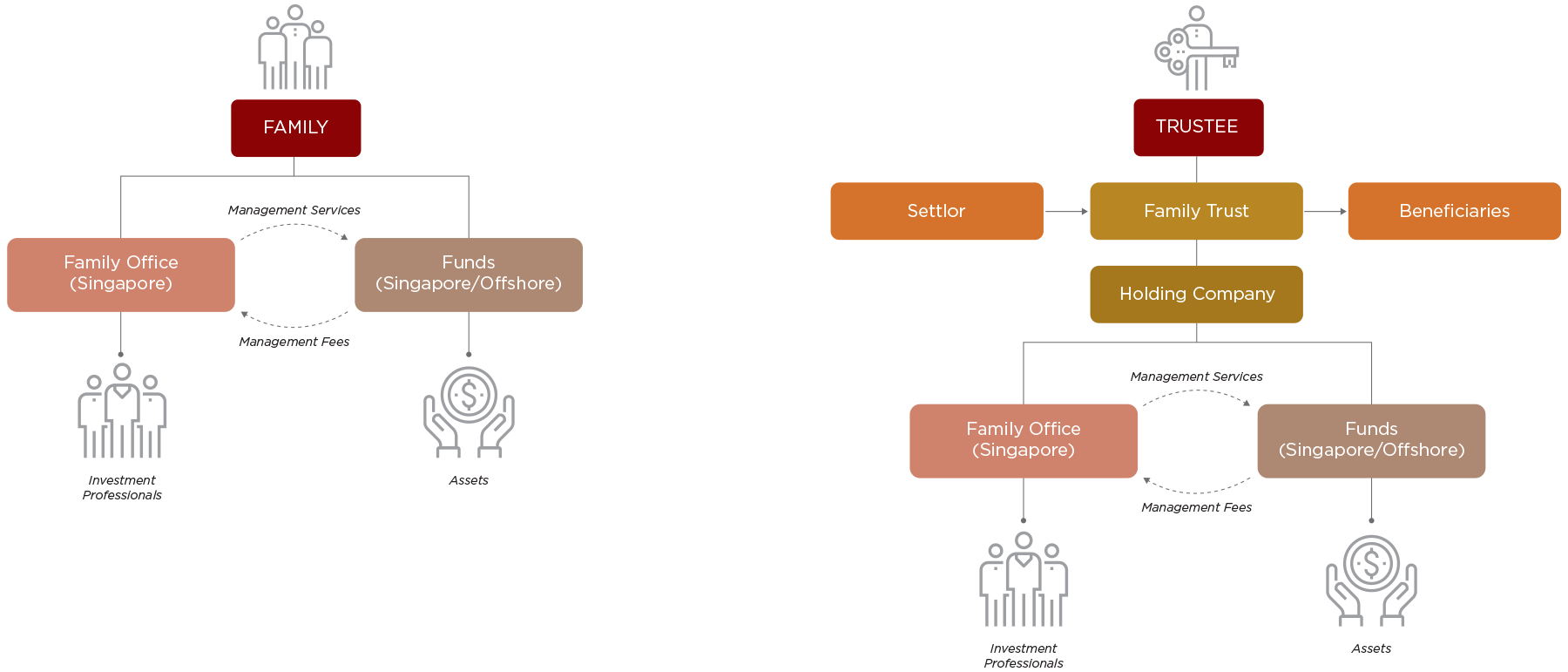

The graphics below depict typical structures of family offices.

There are various tax incentive schemes for SFOs established in Singapore. These are:

What is “Family”?

Under the Section 13(O) or Section 13(U) tax incentive scheme, the Monetary Authority of Singapore (MAS) defines “family” as individuals who are lineal descendants from a single ancestor, as well as the spouses, ex-spouses, adopted children and step-children of these individuals.

Minimum spending requirements for SFO

Single Family offices under the S13O scheme must incur a minimum total local business spending of S$200,000 annually.

Single family offices under the S13U scheme must incur a minimum local business spending of S$200,000 annually. For the local business spending requirements, expenses incurred should relate to the operating activities of the fund, as opposed to financing activities.

All minimum spending requirements are governed by a tiered framework based on the value of the Assets Under Management (AUM) and pro-rated from the commencement date of the incentive to the first financial year end after commencement. After that, the full minimum spending requirements apply for all subsequent years. Incorporation expenses would not be eligible as business spend as they are deemed capital in nature.

We are a professional services company that can help families handle the setting up family office in Singapore. We have a comprehensive ecosystem of partners (including lawyers, auditors, tax advisers, property and insurance agencies, fund administrators, banks, and prime brokers/custodians) who can help you meet your needs. As such, we can provide customised solutions based on each family’s needs and goals.

Our services include:

There are generally 2 different entities established under an SFO setup: the SFO and the fund entity. The SFO is the management entity that fulfils the family’s needs and manages the family assets held by the fund entity.

The incorporated fund entities may be variable capital companies (VCC) that the SFO invests in or sets up on its own, subject to regulatory requirements.

For family offices registering under the S13O scheme – locally incorporated structures – the minimum fund size is S$20 million at the point of application and throughout the incentive period.

The value of the minimum AUM for the S13U scheme is S$50 million at the point of application and throughout the incentive period.

Family offices under the S13O scheme must hire at least two investment professionals (IP), with at least one IP being a non-family member.

Under the S13U scheme, family offices are required to hire at least 3 IPs, with at least one IP being a non-family member.

An “investment professional” is a qualified Singapore tax resident employed as Traders, Research analysts, or Portfolio managers. They must earn more than S$3,500 monthly, have substantial industry experience and engage more than 50% of the time in the qualifying activity.

Investors who meet the minimum investment of S$2.5 million in a Singapore start-up or business may apply for permanent residence status for themselves and their immediate family under the Global Investor Programme (GIP).

Under the GIP SFO option, the family office principal (the person managing the SFO) may apply for permanent residency in Singapore. However, the SFO must have an Net Investible Assets* of at least S$200 million, with a minimum of S$50 million held in Singapore any of the 4 investment categories of:

Furthermore, the principal must have at least 5 years of entrepreneurial, investment or management track record and have net investible assets of at least S$200 million.

*Net Investible Assets include all financial assets, such as bank deposits, capital market products, collective investment schemes, premiums paid in respect of life insurance policies and other investment products, excluding real estate. The Singapore government has discretion to assess suitability of applicants’ Net Investible Assets.